Prove every expense is Reasonable, Allocable, and Necessary (RAN) with automated 2 CFR 200 compliance tracking. Navigate policy changes and multi-funding requirements while keeping QuickBooks® as your financial foundation.

Automated RAN Compliance for Multi-Funding Federal Recipients

Navigate the unstable federal grant environment with automated proof that every expense is Reasonable, Allocable, and Necessary—without abandoning QuickBooks:

Multi-Funding Source Allocation Engine

Automatically allocate expenses across federal, state, and private funding sources while maintaining QuickBooks as your single source of truth. Built-in RAN documentation ensures every allocation meets audit requirements for multiple funding streams.

"Finally, we can prove every expense is reasonable, allocable, and necessary across 6 federal funding sources without leaving QuickBooks. Our last audit was flawless."

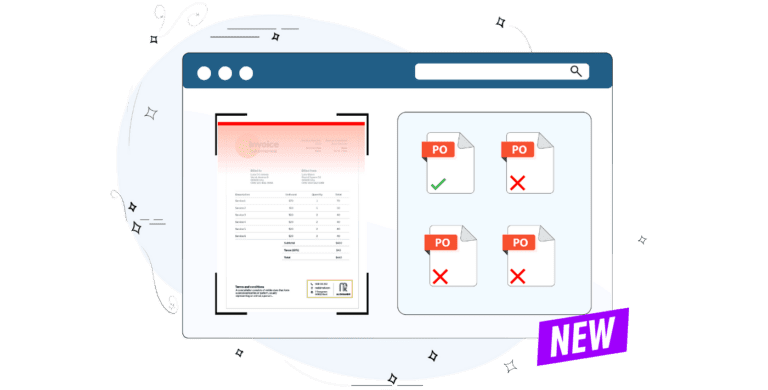

RAN Compliance Automation

Every expense automatically validated as Reasonable, Allocable, and Necessary with built-in GSA travel rate integration and policy change monitoring. Adapts to evolving federal requirements while maintaining audit-ready documentation trails.

Policy-Adaptive Internal Controls

Built for the unstable federal grant environment with internal controls that automatically update as policies change. Maintains compliance continuity when funding requirements shift, protecting against questioned costs from evolving federal interpretations.